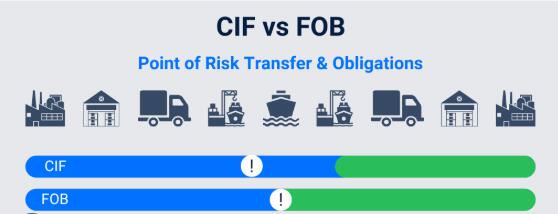

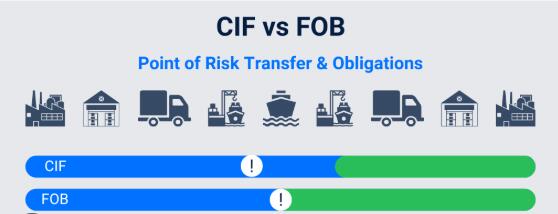

What is the Difference Between CIF and FOB?

Incoterms (International Commercial Terms) are very important in international trade since they spell out the costs, risks, and responsibilities of buyers and sellers. CIF (Cost, Insurance, and Freight) and FOB (Free on Board) are two of the most common terminologies.

Even though both phrases talk about how things are shipped and when risk transfers, they give different people different jobs. Importers and exporters can prevent costly mistakes by knowing about these distinctions.

What is FOB (Free on Board)?

FOB stands for "Free on Board" (the name of the port of shipment). The seller has done their part when the products are loaded onto the buyer's chosen vessel at the port of shipment.

What the seller has to do under FOB:

- Bring the goods to the port of shipment that was named.

- Get the products ready to leave.

- Put the products aboard the ship that the buyer has chosen.

What the buyer has to do under FOB:

- Pay for shipping and insurance for items sent abroad.

- Take assume all risks once the products are on board.

- Take care of customs clearance and duties for imports.

Think about buying fruit at a market. After the seller puts the fruit in your car, it is your job to take care of it. The vendor is no longer responsible if something happens on the way home.

What is CIF (Cost, Insurance, and Freight)?

CIF stands for "Cost, Insurance, and Freight" (the name of the port of destination). The vendor puts the products aboard the ship and makes arrangements for freight and insurance to the port of destination. Risk still transfers once the goods are loaded on board, but the seller bears additional responsibilities.

What the seller has to do under CIF:

- Bring the goods to the port of shipment that is indicated.

- Make sure the goods are ready to be shipped.

- Pay for shipping to the port of destination.

- Give at least some insurance coverage while in transit.

The buyer's duties under CIF are:

- Once the products are on board, you are responsible for them.

- Take care of customs clearance and duties for imports.

- Buy more insurance if you need more coverage.

This is like buying something pricey online. The vendor not only sends it to you, but they also acquire basic insurance in case it is damaged while being shipped.

Key Differences Between CIF and FOB

| Aspect | FOB (Free on Board) | CIF (Cost, Insurance, and Freight) |

|---|---|---|

| Who pays for freight? | Buyer | Seller |

| Who pays for insurance? | Buyer | Seller (minimum coverage) |

| Risk transfer point | When goods are loaded on board | When goods are loaded on board |

| Control of shipment | Buyer arranges freight & insurance | Seller arranges freight & insurance |

| Best for | Buyers with logistics expertise | Buyers wanting convenience |

Advantages and Disadvantages

Benefits of FOB:

The buyer is in charge of shipping and insurance.

Usually cheaper if the customer has superior shipping alternatives.

Clear logistical procedure.

FOB Problems:

The buyer has to do more work to arrange transportation.

The buyer is at a higher risk if they don't have the right insurance.

Benefits of CIF:

The seller takes care of shipping and insurance, which makes things easier for the customer.

Easy for buyers who don't know what they're doing.

Gives at least some protection for cargo.

Cons of CIF:

The buyer has less say over shipment and costs.

The insurance offered may not be enough or very little.

Even though the seller pays for shipping, the risk still moves at the port of shipment.

Which Term Should You Choose?

Choose FOB if:

You want to have greater say over shipping and insurance.

You already have good logistical partners.

You want to know exactly how much shipping will cost.

Choose CIF if:

You want the seller to handle logistics since it's easier for you.

You are new to doing business with other countries.

You don't mind paying a little more for less work.

Other factors to consider:

What kind of items they are (delicate, precious, big, etc.).

The distance of transportation and the risks that come with it.

How things are done in the exporting country's market.

Conclusion

The key difference between CIF and FOB is who pays for shipping and insurance and who is in charge of the shipping procedure. Under FOB, the customer is in charge after the products are loaded. Under CIF, the seller organizes freight and insurance, but the risk still passes to the buyer after the goods are on board.

There is no one "better" choice for everyone. What you choose relies on how much experience you have in trading, how well you can handle logistics, and what kind of commodities you have. To avoid arguments, always make sure that contracts spell out duties and risks.

FAQ

Q1: Is CIF better than FOB?

Not necessarily. CIF is more convenient, while FOB offers more control and potentially lower costs.

Q2: Who pays for insurance in CIF?

The seller pays for minimum insurance, but the buyer can purchase extra coverage.

Q3: When does risk transfer in FOB?

Risk transfers to the buyer once the goods are loaded on board the vessel.

Q4: Can CIF and FOB be used for air freight?

No. CIF and FOB are strictly maritime Incoterms. For air shipments, other terms such as CIP or FCA should be used.